Referral Bonus

Sign up with referral code

and get another $30 free cash into your Singlife account when you apply for a Grow Policy!

Tips to ensure that the referral code is properly applied, please follow closely:

1. Make sure you install the latest Singlife app (version 5.3.0 or later)

2. Apply referral code

3. Create a Singlife ID

4. Inforce your Singlife Account

5. Order your Singlife Visa Debit Card (free)

6. Activate your Singlife Visa Debit Card

Upon completion of steps 1-6, you will receive a top-up of $5 free into your Singlife Account

7. Apply for FIRST* Singlife Grow Policy (Important: dont press Skip! pls see below gif image to make sure you input the referral code correctly for this!)

8. Fund your FIRST Singlife Grow Policy

9. FIRST Singlife Policy is in force

* Subsequent Singlife Grow Policy will not qualify for additional top-up. Only the first policy will qualify.

Upon completion of steps 7-9, you will receive a top-up of $30 free into your Singlife Account.

Singlife Manage

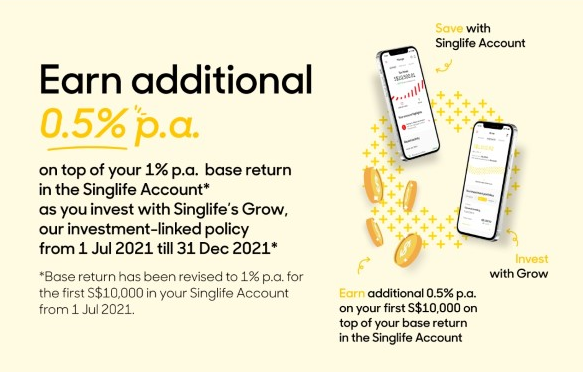

Grow Bonus

Signing up

You will need to download and install the Singlife app to create an account with your mobile number. You can either enter your details manually or via SingPass MyInfo.

The process takes around 10mins. You also need to verify your email.

You can easily withdraw/deposit funds via FAST

With the Singlife Account, it’s easy to FAST transfer money in and out from your bank account.

After the Singlife account was created, the app provided me with a DBS account number to fund my account.

I transferred funds to it via FAST and it was updated within the Singlife app within a couple of minutes.

I can do this any time of the day, and as many times as I want. This also means that my money isn’t stuck in here like some investments that usually come with a lock-in period.

The termination process is almost instant. Insurance coverage, interest crediting and the Singlife Card will cease.

The account value will be credited to your bank account via FAST. If you change your mind, you can reinstate your Singlife Account anytime which is subject to approval.

MAS Licensed

Singapore Life Pte. Ltd. (Singlife) is a direct life insurer licensed by the Monetary Authority of Singapore (MAS).

Protected by SDIC

All Singlife policies, including the Singlife Account are covered under the Policy Owners’ Protection (PPF) Scheme administered by Singapore Deposit Insurance Corporation (SDIC). The PPF Scheme protects policy owners in the event a life insurer which is a PPF Scheme member fails.

Singlife Account is not a bank account

The Singlife Account is an insurance savings plan. It is neither a bank savings account nor fixed deposit

Insurance Benefits

You get life insurance coverage of up to 105% of your account value and retrenchment benefits.